CrowdStrike's Massive FCF Margins Could Push CRWD Stock 25% Higher

/Technology%20-%20thisisengineering-raeng-yhCHx8Mc-Kc-unsplash.jpg)

CrowdStrike Holdings (CRWD) stock still looks undervalued here. This is based on its massive free cash flow and FCF margins. CRWD stock could be worth at least $485 per share, or over 25% higher. Shorting OTM puts makes sense here.

CRWD stock is trading at $383.60 on July 2 in morning trading. The stock has been moving higher since its fiscal Q1 2025 (April 30, 2024) results were released on June 4.

I discussed CrowdStrike's value in my June 9 Barchart article, “CrowdStrike Looks Undervalued Based on Its High FCF Margins and Its Outlook.” I showed how CRWD was worth $412 when trading for $349.12.

Shorting Puts in CRWD Stock

In the article, I suggested shorting the June 28 expiration $330 strike price puts for $5.00 per put contract. On June 28 CRWD stock closed at $383.19 on June 28. So that short put play expired worthless, making it profitable to the short seller.

For example, it provided a 1.515% yield to the short seller (i.e., $5.00/$330.00 = 1.515%). There was also no further obligation to buy shares at $330, if the stock closed there on June 28 or earlier. Nevertheless, given the stock's rise, this type of play works best for long holders of CRWD stock.

Moreover, I have now raised my price target to $485.00 per share, or 25% higher than today's price. This article will describe why. Shorting new OTM puts is a good way to make extra income for existing shareholders.

It also is a disciplined way to set a good buy-in target for more risk-averse investors in CRWD stock. It makes sense to repeat this OTM short-put play. But first, let's look at why CRWD stock could be worth as much as $485 over the next year.

Setting a Price Target

In my last article, I showed that CrowdStrike made a 35% free cash flow (FCF) margin on sales in its latest quarter. If the company can continue to do this over the next fiscal year, the stock could be valued much higher.

For example, analysts now project that revenue will rise 25% next fiscal year ending January 2026. They project sales of $5.06 billion vs. $4.0 billion for the year ending Jan. 2025.

Since the market always projects forward in its valuations, we can use the Jan. 2026 revenue forecast. For example, applying a 35% FCF margin to $5.06 billion in projected sales means FCF could rise to $1.77 billion.

As a result, applying a 1.5% FCF yield metric results in a projected market cap of $118.07 billion (i.e., $1.77b/0.015 = $118.07b). This means that if CrowdStrike were to pay out 100% of FCF (either in dividends or in buybacks) the market would give the stock a 1.5% dividend yield.

This $118.07 billion market value estimate over the next year is 26.4% higher than the stock's $93.42 billion market cap today. In other words, CRWD stock is worth 24.6% more. That means multiplying the price today $383.60 x 1.264 = $484.87. I rounded that up to $485 per share as a price target.

Analysts Have Higher Prices As Well

Analysts on Wall Street also have higher price targets. For example, the average of 41 analysts surveyed by Barchart is $395.51. Yahoo! Finance says the average price target of 44 analysts is $400.37 per share.

Moreover, AnaChart, a new sell-side analyst tracking service, reports today: “CRWD is currently covered by 41 analysts with an average price target of $432.56. This is a potential upside of $40.41 (10.3%) from yesterday's end-of-day stock price of $392.15.”

The top analysts surveyed by AnaChart now have very good track records predicting CRWD stock's price gains. Many of these analysts have hit their price targets 90% or more of the time.

The table above shows that the Price Targets Met Ratio is very high for these five analysts. Note that they all have much higher price targets than today's price.

The bottom line is that CRWD stock still looks undervalued. One way to play this, especially for existing shareholders, is to short OTM puts in nearby expiry periods.

Shorting OTM Puts Again

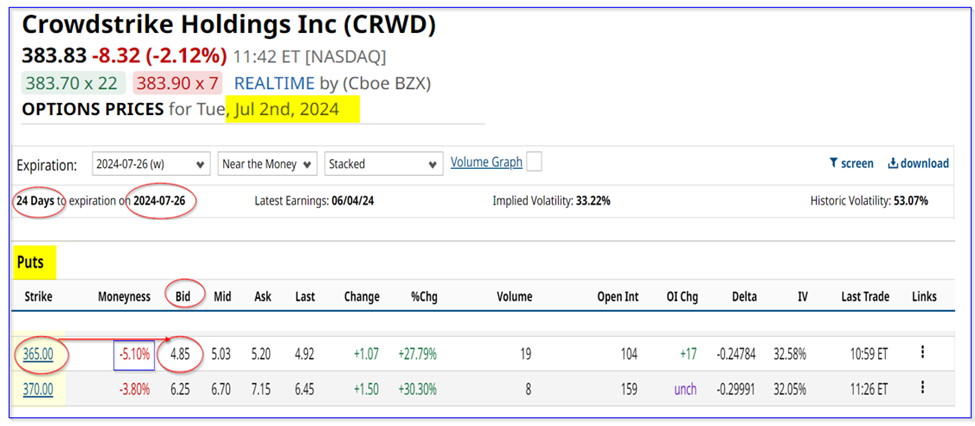

For example, look at the July 26 expiration period, 24 days from now or just over 3 weeks away. The $365 strike price put contract trades for $4.85 on the bid side.

That provides an immediate yield of 1.33% for the short seller of these puts, with just over 3 weeks to go. Moreover, the strike price is 5% below today's price (i.e., out-of-the-money).

This means the short seller has good downside protection. For example, the short seller's breakeven price would be $365-$4.85, or $360.15 per share. That is 6.14% below today's price, a good downside hedge.

If the investor previously shorted the $330 puts, they now have made 2.845% (i.e., 1.515% +1.33%). In other words, their breakeven is almost 3% below today's price. Keep in mind, though, that this kind of trade works best for long shareholders. It is a way to pick up extra income while waiting for the stock to move higher.

The bottom line is investors can expect to see CRWD stock move over 25% higher over the next year. One way to play this is to short OTM puts repeatedly in nearby expiry periods.

More Stock Market News from Barchart

- There’s An Argument to Be Made Why Hawaiian Electric Industries Is a Bottom 100 Stock to Buy

- Halliburton's Q2 2024 Earnings: What to Expect

- Roper Technologies Earnings Preview: What to Expect

- 2 Top-Rated Semiconductor Stocks Set to Outperform

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.